Is It Really Worth Taking the Certified Public Accountant (CPA) Exam?

Dec 31, 2023 By Triston Martin

Certified Public Accountant (CPA) is the title given to accountants who meet certain qualifications. Each state's Board of Accountancy issues this license. The American Institute of Certified Public Accountants guides you on how to get this certification. Holding a CPA title is important in the accounting field because it embodies high standards for professionals.

There are also equivalent qualifications to the CPA in other parts of the world, for example, Chartered Accountant (CA) certification. But not every accountant is a CPA. This credential allows accountants to name their commitment, achievements, and abilities. CPAs are responsible for financial matters such as preparing accurate accounts of income and expenditures. They also handle taxes, helping people and companies avoid paying unnecessary amounts of tax money or running into losses on profits.

A business, finance, or accounting degree is required to become a CPA. Also, you must complete 150 hours of education and work in public accounting for at least two years. Passing the Uniform CPA Exam is an important step in this process. Being a CPA is not the end. You must study every year to keep up your designation.

History of the CPA Designation

They also established ethical guidelines and auditing standards for governments and private entities, such as businesses. In the late 1800s, 31 accountants joined forces to form an organization in the U.S. devoted to this purpose called the American Institute of Certified Public Accountants (AICPA). Originally called the American Association of Public Accountants, this organization has gone through several name changes and, since 1957, has been known as the American Institute of Certified Public Accountants. In 1896, the profession of Certified Public Accountants became a reality when CPA licenses were issued for the first time.

In 1934, a turning point was reached when the newly established Securities and Exchange Commission decreed that all publicly traded companies had to have their financial reports audited by professional accountants. Setting accounting standards was originally the responsibility of AICPA, but in 1973, this went to a parallel group funded by private companies.

The late 1990s, in particular, saw a boom in the accounting field when major firms also began offering consulting services. However, in the early 200s, a huge change occurred. After Enron, everything changed--and not for the better. Not only did this affair land Arthur Andersen, one of the Big Eight accounting firms in America then. The legislation was more demanding of accountants, especially regarding their consulting roles.

The CPA Exam

The extensive CPA exam features 276 MCPs, 28 simulations of tasks, and three written segments. It's broken down into four key areas:

- BEC: Business Environment and Concepts

- AUD: Auditing and Attestation

- REG: Regulation

- FAR: Financial Accounting and Reporting

In terms of scoring, the multiple-choice questions and task-based simulations each makeup half of the total score. To pass each section, you need a minimum score of 75%. Candidates are given four hours to complete each section, totaling 16 hours for the entire exam. You can take these sections one at a time and in any order you choose. However, there's a catch: You must pass all four sections within 18 months. The start of this 18-month window can vary depending on your location.

CPA Career Options

A certified public accountant (CPA) may find employment in various settings, including private practice, large corporations, or even the public sector. Executive roles like controllers and chief financial officers (CFOs) are open to those with the Certified Public Accountant credential.

Earning the Certified Public Accountant designation often leads to a career in accounting. Simply said, they assist businesses in preparing, updating, and reviewing their financial statements and associated activities. For both individuals and corporations, many CPAs handle tax preparation and filing. Auditors who are certified public accountants are qualified to conduct and certify all audits.

While certified public accountants are most often associated with preparing individual income taxes, they have numerous other areas of expertise, including the auditing process, financial management, criminal accounting, management accounting, and even certain areas of information technology (IT).

Working for private enterprises or in corporate accounting does not need a certified public accountant license qualification. Public accountants who work for companies like Deloitte or Ernst & Young and provide accounting and tax services to corporations must have a Certified Public Accountant credential.

CPA Code of Ethics

An ethical code is in place for certified public accountants. The Code of Professional Conduct outlines the moral requirements that CPAs must follow, and the AICPA requires all individuals holding the CPA certification to follow it. The Enron affair shows certified public accountants' failure to follow this code. Those in authority and certified public accountants at Arthur Andersen faced accusations of immoral and unlawful accounting practices.

Accountants are legally obligated to be impartial when conducting audits and reviews, both at the federal and state levels. Arthur Andersen CPAs violated the ethical rules for certified public accountants by providing auditing and consulting services to Enron without maintaining independence. Following corporate financial crises such as the Enron incident, the Sarbanes-Oxley Act, also known as SOX of 2002, was enacted partly as a reaction, and the Certified Public Accountant qualification has assumed more significance.

CPA vs Accountant

A certified public accountant license is a certification that accountants may get. Therefore, certified public accountants often serve in the same capacity as non-certified public accountants. In all cases, the public does not have access to CPA services. These include compiling audited financial statements (such as a company's income statement or balance sheet) and conducting audits of publicly traded corporations in the United States.

CPA vs. MBA

A master's degree in business administration is known as an MBA. An MBA, which is more all-encompassing, could be the way to go if you want to launch or manage a company. A certified public accountant (CPA) is a credential that accountants may get. You could succeed more as a certified public accountant if you consider yourself a "numbers person" or just interested in accounting.

Final Verdict: Should You Go For CPA?

A significant time commitment is involved in earning the certified public accountant license certification and passing the test is no picnic. On the other hand, certified public accountants make 25% more than their non-certified counterparts. Additionally, accountants who have earned their CPA credentials generally find themselves elevated to roles with greater responsibility within a year or two after starting their careers and then to senior-level positions not long after that.

-

Banking Nov 20, 2023

Banking Nov 20, 2023A Magical Experience with Universal Orlando's Free Express Passes!

Discover which Universal Orlando hotels offer free Express Passes and learn how to make the most of this money-saving perk.

-

Investment Jan 12, 2024

Investment Jan 12, 2024Land Investment: Understanding Benefits and Potential Risks

Are you interested in land investments? Get a comprehensive guide to the types of land plots and gain insight into their advantages and disadvantages.

-

Banking Nov 07, 2023

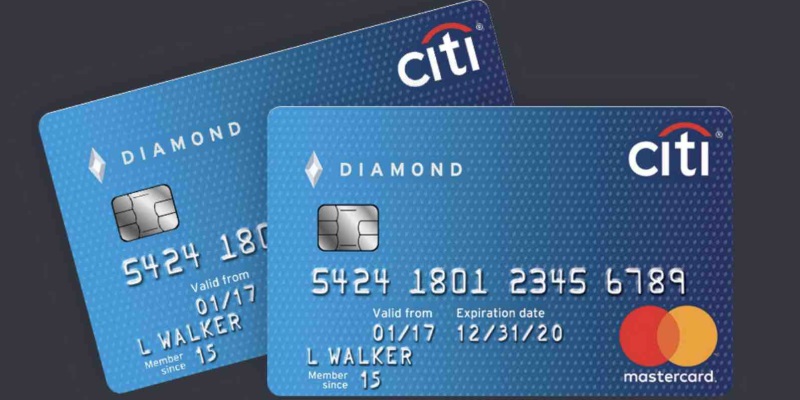

Banking Nov 07, 2023Boost Your Purchasing Power: How to Request a Citi Credit Limit Increase

Ready to boost your purchasing power? Learn how to request a Citi Credit Limit Increase in a few simple steps and get the extra credit you need today!

-

Know-how Nov 06, 2023

Know-how Nov 06, 2023USAA Credit Card Application Status: Your Comprehensive Checking Guide

Discover your USAA Credit Card application status with our comprehensive guide. Get the answers you need today.