Boost Your Purchasing Power: How to Request a Citi Credit Limit Increase

Nov 07, 2023 By Triston Martin

Are you feeling limited by your current credit card spending ability? Maybe you've had your Citi Credit Card for a while, and your financial situation has improved, or you just want a bit more flexibility. Whatever the reason, increasing your credit limit can be a helpful solution.

In this guide, we'll walk you through the process of requesting a Citi Credit Limit Increase in a way that's easy to understand. There is no need for corporate jargon – just straightforward steps to help you gain the extra credit you need.

Why Increase Your Credit Limit?

Before we dive into the how, let's talk about the why. Why should you consider increasing your Citi Credit Limit? There are several good reasons:

Flexibility: A higher credit limit gives you more financial flexibility. It allows you to make larger purchases, handle unexpected expenses, and manage your finances more effectively.

Credit Score: Increasing your credit limit can positively impact your credit score. It can lower your credit utilization ratio, which is the percentage of your credit limit that you're currently using. A lower ratio can boost your credit score.

Emergency Safety Net: It's always a good idea to have a financial safety net. A higher credit limit can serve as a backup plan for unexpected emergencies.

Requesting a Citi Credit Limit Increase

Now that you understand the benefits let's get into the nitty-gritty of requesting a Citi Credit Limit Increase.

Check Your Eligibility

Before making your request, it's important to ensure you meet Citi's eligibility requirements. Citi typically considers the following factors:

Payment History: A good track record of on-time payments is crucial. Make sure you've been making your Citi Credit Card payments consistently.

Credit Score: A higher credit score improves your chances of getting an increase. Aim to maintain a good credit score to boost your eligibility.

Account Age: The longer you've held your Citi Credit Card, the better your chances. Citi often prefers customers with established accounts.

Income: A higher income can work in your favor. It demonstrates your ability to manage increased credit responsibly.

Usage: Regularly using your Citi Credit Card but not maxing it out can show responsible credit usage.

Decide on the Increase Amount

How much of a credit limit increase do you need? Citi allows you to request an amount when you apply. It's essential to think this through and determine the right amount for your needs. Requesting a reasonable increase increases your chances of approval.

Ways to Request a Citi Credit Limit Increase

Citi offers multiple channels to request a credit limit increase. You can choose the method that suits you best:

Online through Your Citi Account:

- Log in to your Citi account.

- Navigate to the credit limit increase section.

- Follow the prompts to submit your request.

- Provide any required information.

Via Citi Mobile App:

- Open the Citi Mobile App.

- Find the credit limit increase option.

- Input the requested information and submit your request.

Call Customer Service:

- Dial the number on the back of your Citi Credit Card.

- Speak to a customer service representative and express your request for a credit limit increase.

Mail or Fax Request:

If you prefer traditional methods, you can send a written request via mail or fax to the address or number provided by Citi.

In-Branch Visit:

Visit a local Citi branch if there's one nearby. Speak to a representative and make your request in person.

Choose the method that you're most comfortable with, and ensure you have all the necessary information, like your income and current credit limit, ready.

What to Include in Your Request?

When you request a Citi Credit Limit Increase, it's essential to provide all the necessary information to maximize your chances of approval. Here's what you should include:

- Personal Information: Your name, contact details, and any other requested personal information.

- Financial Details: Be ready to provide your income information. Citi needs to know that you can handle a higher credit limit responsibly.

- Current Credit Limit: Mention your current credit limit to help the bank assess your request correctly.

- Requested Increase Amount: Clearly state how much of an increase you're requesting.

After you've submitted your request, it's time to wait for Citi to review your application and make a decision. Citi typically provides a decision within a few business days, so the process is relatively quick. If your request is approved, congratulations are in order, and you'll receive an updated credit limit to enjoy.

On the other hand, if your request is denied, there's no need to worry. You can either reapply in the future, taking into consideration the tips provided earlier, or explore alternative options.

Tips for a Successful Request

Increase your chances of getting a credit limit increase with these helpful tips:

Pay Your Bills on Time: A consistent history of on-time payments is a strong indicator of financial responsibility.

Maintain a Good Credit Score: Work on improving and maintaining a good credit score, as it plays a significant role in Citi's decision-making.

Use Your Card Regularly: Show that you're an active user of your Citi Credit Card. Regular, responsible usage can work in your favor.

Don't Request Too Soon: If you've recently requested a credit limit increase or had one granted, it's advisable to wait at least six months before requesting another one.

Income Documentation: Have your income documents ready. Providing proof of a stable income can boost your eligibility.

Clear Outstanding Balances: Reducing your outstanding balances before making the request can demonstrate responsible financial management.

Conclusion

Requesting a Citi Credit Limit Increase doesn't have to be a daunting task. It's a straightforward process that can provide you with better financial flexibility and potentially boost your credit score.

Remember to check your eligibility, decide on the increased amount, and choose a convenient method to make your request. Be patient while waiting for a response, and use the tips provided to increase your chances of approval.

-

Investment Dec 21, 2023

Investment Dec 21, 2023What Is The Nasdaq 100 Index?

Learn the Nasdaq 100 Index and how to invest in it. In this guide, we explain the index's components, its differences from the S and P 500, and frequently asked questions about investing in it.

-

Investment May 18, 2024

Investment May 18, 2024Everything You Should Know About The Squeeze Momentum Indicator

The Squeeze Momentum Indicator (SMI) allows traders to expect marketplace breakouts by recognizing low volatility durations.

-

Banking Nov 07, 2023

Banking Nov 07, 2023What Happens If You Don’t Activate Your Credit Card?

Discover the consequences of neglecting to activate your credit card! Dive into the real-world impacts, from missed rewards to potential security risks

-

Know-how Sep 07, 2024

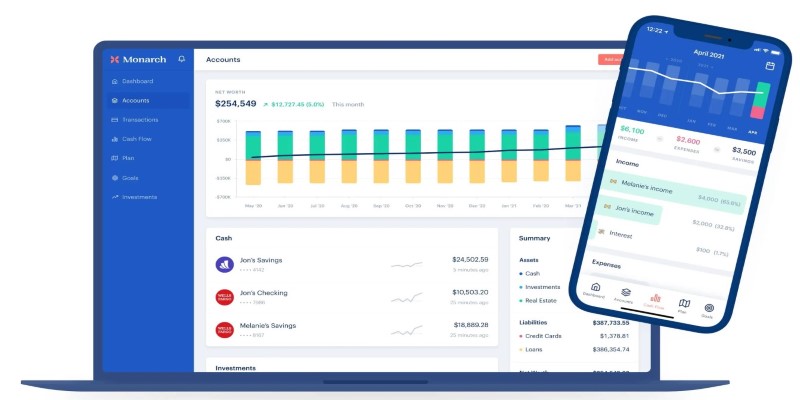

Know-how Sep 07, 2024Finding the Right Net Worth Tracker: A Guide for 2024

How to choose the best net worth tracker in 2024 with our detailed guide. Learn what features to look for and how to find a tracker that fits your financial goals