A Comprehensive Guide to Dispute Wells Fargo Credit Card Charges

Nov 06, 2023 By Susan Kelly

There are a lot of different financial institutions, and among them is Wells Fargo. This is considered one of the largest banks in the United States, and the best part is that they have a huge customer base. The best thing about Well Fargo is that they are offering charges back to the merchants who have collaborated with them.

The chargebacks can be a hectic process, and therefore, not everyone likes to do it. This can be a waste of time, causing product loss, revenue loss, and additional fees are also when it comes to this. However, in some cases, the chargeback becomes essential. Therefore, if you are someone who wants to learn how to dispute Wells Fargo Credit Card charges, then this article is just for you.

What is the Wells Fargo Dispute?

Many people might not know what the Wells Fargo dispute is and how it works. This is basically a dispute or a problem that occurs when there is a merchant involved, and there is an issue with the Wells Fargo credit or debit card.

This is basically when a bank customer is inaccurately charged, and they see it on their Wells Fargo bank statement. When the customer has seen that there has been something off with the transactions, they need to contact the merchant from where it is wrongly charged. If the merchant does not solve the issue, then the customer needs to complain to Wells Fargo and ask them to dispute the transaction.

During this time, the customer will be issued a temporary refund for the amount that is charged incorrectly. They will also not be asked to pay for the amount that is pending on the case. Other than this, they won’t be asked or charged for the interest or the late fee while this problem is being solved.

How Does Wells Fargo Dispute the Credit Card Charge?

Now the question comes how does Wells Fargo work, and how does it solve the credit card issue? Mentioned below is a detailed guide through which you will be able to understand how Wells Fargo works and how it solves the chargeback issues.

- The first thing is when the customer is not satisfied with the things they have been charged for and when they find there is something wrong with the transactions. They need to file the chargeback dispute with their bank and let them know what the problem is.

- After the complaint of the chargeback is filed, Wells Fargo will start their investigation related to the dispute. They will find out what the problem is and whether the chargeback dispute is valid or not. If it is valid they will accept it, but if they find that the chargeback is not valid ten, they will reject it.

- When the dispute is received, Wells Fargo will see a notification to the merchant. They will also debit the disputed amount from the merchant's bank account when they find that the chargeback was correct.

- Once merchants get the notice, they have a chance through which they can contest the chargeback. This means they can send the notification back to Wells Fargo with the evidence and ensure that the transaction is accurate and legitimate.

- The final call will be from Wells Fargo. They will look at the evidence and receipts provided by the merchant. They will also look back into the complaint that the customer made. After that, they will make the final decision, and if the decision is in favor of the merchant, then they will get back the amount that was debited from their account.

How to File a Dispute of a Wells Fargo Chargeback?

The next thing you should know is how you can dispute the Wells Fargo chargeback and the steps that you need to take. The process can be complex, and people might not understand how to do all the steps. Hence, the following are the steps that you need to take.

Gather the Information:

Before even filing the dispute, you need to ensure that you have all the necessary documentation. This means you need to have the transaction details; you should have proof of delivery and other information that you think will help you make your case stronger.

Contact Wells Fargo:

The next step is to contact Wells Fargo. This means you need to contact them through phone, email, or even online platforms to file the dispute. Here, you will be needed to provide all the necessary information and ensure you are submitting all the documents.

Preparing an Argument:

Now, you need to make an argument that needs to have all the essential facts and figures related to your case. You need to ensure that you are giving them all the information so that they know why and how you were inaccurately charged from your card.

Responding within the Time Frame:

The next important thing is to make sure you are working within the time frame. There is a deadline that Wells Fargo provides that you need to follow if you want to solve the dispute.

Continuously Follow Up:

The last step is to ensure that you are following up on your dispute. Sometimes, the bank might forget about your case, or sometimes, you need to remind them to work on your case quickly. Also, the follow-up is necessary, so in case they need any documentation, you can provide them within the time period.

Final Words:

Wells Fargo is a reputed bank that has been working for thousands of customers. They are known for their fantastic service, and one thing that you should know about them is that they ensure that their customers are satisfied. This is why they are also offering the chargeback option to their customer. Hence, we hope with the help of this article, you know how to dispute the credit card cash in Wells Fargo and solve this issue.

-

Investment Nov 20, 2023

Investment Nov 20, 2023The Difference Between PPO And HMO Health Insurance

Confused about the difference between HMO and PPO Health Insurance? This article simplifies the jargon and breaks down the pros and cons of each to help you make an informed decision.

-

Know-how Nov 07, 2023

Know-how Nov 07, 2023Discovering Your Citi Credit Card Application Status

Wondering about the status of your Citi Credit Card application? Find out how to check your Citi Credit Card application status with our simple guide.

-

Know-how Sep 07, 2024

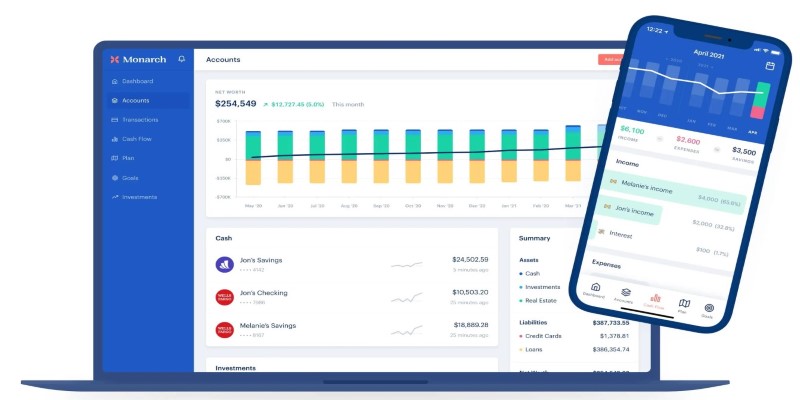

Know-how Sep 07, 2024Finding the Right Net Worth Tracker: A Guide for 2024

How to choose the best net worth tracker in 2024 with our detailed guide. Learn what features to look for and how to find a tracker that fits your financial goals

-

Mortgages Nov 08, 2023

Mortgages Nov 08, 2023First Citizens Bank Mortgage Review

Planning to take a mortgage from the First Citizen Bank but wanted to know more about it? This First Citizens Bank Mortgage Review got you covered