Understanding Available Credit vs. Credit Limit: What's the Difference?

Nov 07, 2023 By Susan Kelly

When it comes to managing your finances, understanding key terms is crucial. Two terms that often cause confusion are "Available Credit" and "Credit Limit." In simple terms, they play a significant role in your financial well-being. Let's break down the difference between these two terms to help you navigate the world of credit more effectively.

Credit Limit Explained

Your credit limit is like a financial safety net provided by your credit card issuer. It represents the maximum amount of money you're allowed to borrow on your credit card. Think of it as a predefined spending cap that's determined by factors such as your credit history, income, and other financial details. If your credit limit is $5,000, it means you can make purchases or withdraw cash up to that amount.

What is the Available Credit Limit?

On the other hand, available credit is the actual amount of money you have left to borrow within your credit limit. It's like the remaining space on your credit card before you reach the maximum allowed. For example, if your credit limit is $5,000 and you've made purchases totaling $2,000, your available credit would be $3,000.

The Importance of Monitoring Available Credit

Monitoring your available credit is a crucial aspect of financial management with several key benefits:

Preventing Overspending: By keeping track of your available credit, you can avoid overspending and stay within your budget. It serves as a financial checkpoint, helping you make informed decisions about your purchases and preventing impulsive buying that could lead to financial strain.

Maintaining Financial Health: Available credit is a reflection of your financial health. Regular monitoring allows you to assess your spending habits and make adjustments if needed. This proactive approach contributes to maintaining a stable and sustainable financial situation.

Avoiding Credit Limit Exceedance: Exceeding your credit limit can result in fees, increased interest rates, and potential negative impacts on your credit score. Monitoring your available credit helps you stay well below your credit limit, preventing these undesirable consequences.

Credit Score Management: Lenders consider your credit utilization ratio when evaluating your creditworthiness. This ratio is the percentage of your credit limit that you're currently using. By keeping an eye on your available credit and managing your credit utilization, you contribute positively to your credit score.

Financial Planning: Understanding your available credit enables better financial planning. You can allocate funds for essential expenses, savings, and emergencies while ensuring that you don't max out your credit card. This proactive planning fosters financial stability and security.

Timely Decision-Making: Monitoring available credit allows you to make timely decisions regarding your finances. Whether it's adjusting your spending habits, paying down outstanding balances, or requesting a credit limit increase, being aware of your available credit empowers you to take action when necessary.

Emergency Preparedness: In case of unexpected expenses or emergencies, having available credit provides a financial safety net. Regular monitoring ensures that you are aware of how much of this safety net remains, allowing you to respond effectively to unforeseen financial challenges.

Identifying Unauthorized Activity: Regularly reviewing your credit card statements and available credit helps you quickly identify any unauthorized or suspicious transactions. Early detection of fraudulent activity allows you to report it promptly, minimizing potential financial losses and protecting your credit.

Negotiating with Creditors: If you find yourself approaching your credit limit due to unforeseen circumstances, being aware of your available credit allows you to communicate with creditors proactively. Negotiating temporary solutions or discussing a manageable repayment plan becomes more feasible when you are informed about your financial situation.

Tips for Managing Available Credit and Credit Limit

Let’s have a look at some of the tips to manage the available credit card limit.

Regular Monitoring: Regularly check your credit card statements to keep a close eye on your spending patterns and to monitor your available credit. This helps you stay informed about where your money is going and ensures that you are within your credit limit.

Utilization Awareness: Be mindful of your credit utilization ratio, which is the percentage of your credit limit that you are currently using. Aim to keep this ratio below 30%, as it positively impacts your credit score. High credit utilization can signal financial instability to lenders.

Budgeting: Create a realistic budget that aligns with your income. Knowing your monthly expenses allows you to plan your spending and ensures that you won't exceed your credit limit. Budgeting also helps you allocate funds for savings and other financial goals.

Emergency Fund: Build and maintain an emergency fund. Relying on credit for unexpected expenses can lead to increased credit utilization. Having a financial cushion can help you cover unforeseen costs without relying solely on your available credit.

Communication with Credit Card Issuer: If you foresee the need for a higher credit limit due to changes in your financial situation, consider communicating with your credit card issuer. However, only request an increase if it aligns with your ability to manage additional credit responsibly.

Timely Payments: Ensure that you make timely payments on your credit card balances. Late payments not only incur fees but can also negatively impact your credit score. Set up reminders or automatic payments to avoid missing due dates.

Credit Score Monitoring: Keep an eye on your credit score regularly. Many credit card issuers provide free access to your credit score. Monitoring your score helps you gauge the impact of your financial decisions on your creditworthiness.

Avoid Maxing Out: While your credit limit represents the maximum you can borrow, it's advisable not to max out your credit card. High balances can lead to financial stress and may negatively affect your credit score. Aim to keep a comfortable buffer within your credit limit.

Conclusion

While credit limit and available credit are related, they have distinct roles in your financial journey. Your credit limit is the maximum amount you can borrow, while available credit is the remaining balance within that limit. Being aware of these terms and managing them wisely can contribute to your overall financial health and creditworthiness. So, keep an eye on your available credit, stay within your means, and make informed financial decisions.

-

Banking Nov 23, 2023

Banking Nov 23, 2023Navy Federal Business Account Features

Navigate the complex business landscape with NFCU—a reliable financial partner. Tailored business solutions for entrepreneurs, unlocking diverse benefits

-

Know-how Nov 20, 2023

Know-how Nov 20, 2023Getting the Most Out of Your Hyatt Program and Hotel Points

Discover the secrets to maximizing the value of your Hyatt Program and hotel points. Learn how to make the most of your rewards for a better travel experience.

-

Know-how Sep 07, 2024

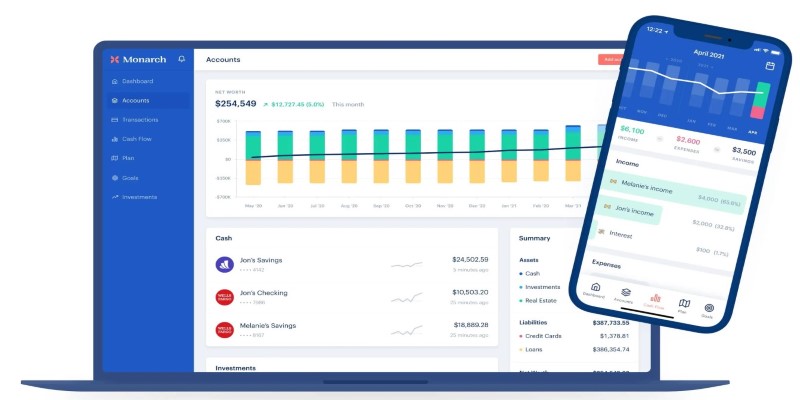

Know-how Sep 07, 2024Finding the Right Net Worth Tracker: A Guide for 2024

How to choose the best net worth tracker in 2024 with our detailed guide. Learn what features to look for and how to find a tracker that fits your financial goals

-

Investment May 10, 2024

Investment May 10, 2024Is EarlyBird the Key to Your Child's Financial Future?

Is EarlyBird the right app to grow your kid's future fund? This EarlyBird review will explain it all!