Low-Rate Savings Account Alternatives

Feb 20, 2024 By Susan Kelly

Are you looking for an alternative to a traditional, low-rate savings account? If so, you are not alone. Many people today are growing increasingly frustrated with the lack of options available in the banking industry when it comes to saving money.

Fortunately, there’s no need to despair: several alternatives offer more competitive interest rates and higher potential returns than the average savings account.

In this blog post, we'll explore some of these options and their benefits so you can decide where your hard-earned cash should go.

Invest in Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are low-risk investments that can offer a higher rate of return than traditional savings accounts. With CDs, you deposit your money into an account for a fixed period and earn interest at a predetermined rate.

The longer the term length on the CD, the more interest you can potentially earn—but it also means locking in the money for longer. CDs are insured by the FDIC up to $250,000 per depositor and offer a guaranteed return, making them an attractive option for those looking for safe investments with higher returns than what traditional savings accounts provide.

Consider money market accounts

Money market accounts (MMAs) are a type of savings account that comes with higher interest rates than typical low-rate savings accounts. These accounts offer the same kind of liquidity and security as regular savings accounts but often require a minimum deposit to open them and may come with other restrictions, such as monthly fees or withdrawal limits.

With MMAs, you can earn a higher rate of return and access your funds without penalty.

Look into Treasury direct bonds

Treasury direct bonds are a great way to invest money and earn interest. They are managed by the U.S. Department of Treasury and backed by the full faith and credit of the United States government, so you can be sure that your investments are safe.

Treasury direct bonds offer a fixed return, which means you know in advance what rate of return you will receive. This makes them a great choice for people looking to invest long-term, as you will not have to worry about fluctuating interest rates. In addition, Treasury direct bonds are free from state and local taxes and offer more security than other investments.

If you’re interested in investing in Treasury direct bonds, it’s important to consider all available options. You can choose from various types of bonds, such as Series I Savings Bonds, TIPS (Treasury Inflation-Protected Securities), and Treasury Notes. Each type has unique features and benefits, so it’s important to research them carefully.

When investing in Treasury direct bonds, it’s important to remember that you will not be able to access your money until the bond matures. This can range from one year up to 30 years, depending on the type of bond you choose. Additionally, there may be penalties for early withdrawal, so make sure you understand all of these terms before investing.

Invest in index funds or exchange-traded funds (ETFs)

Index funds and ETFs offer a great way to diversify your portfolio and take advantage of the stock market without purchasing individual stocks. Index funds expose you to a broad range of investments, such as large-cap companies, mid-caps, or small-caps in various sectors.

ETFs are similar but traded on exchanges like stocks, so you can buy and sell them whenever you want. Investing in index funds and ETFs is a great way to build wealth over the long term, as they have the potential to outpace low-rate savings accounts.

Open a high-yield savings account with an online bank

High-yield online savings accounts offer a great way to maximize your savings. These accounts typically have higher interest rates than traditional brick-and-mortar banks, allowing you to earn more on your money without leaving the comfort of your home.

Not only do these accounts give you access to better returns, but they are also incredibly convenient since they can be accessed online 24/7. In addition, the lack of physical branches eliminates any barriers you may have in terms of access and ease of use.

Take advantage of peer-to-peer lending opportunities

Peer-to-peer lending is an alternative way to use your savings in a low-rate environment. It involves connecting borrowers and lenders, allowing individuals to lend their money directly to each other without needing a financial institution to act as an intermediary.

This allows for greater control over interest rates, which can be advantageous compared to traditional bank savings accounts offering minimal interest. Additionally, many peer-to-peer lending services offer the convenience of automatic payments and direct deposit, making managing your money easier than ever.

It's important to remember that if you choose to use a peer-to-peer service, you should research any potential risks associated with them before moving forward. By understanding the potential rewards and risks involved in using a peer-to-peer service, you can make an informed decision on whether or not this is the right savings option for you.

FAQs

What is the best alternative to a savings account?

The best alternative to a savings account depends on your individual needs and risk tolerance. CDs are a safe option with guaranteed returns, while money market accounts or Treasury direct bonds offer higher yields. Alternatively, investing in index or exchange-traded funds (ETFs) can diversify your portfolio while taking advantage of peer-to-peer lending opportunities can better use your money. Finally, a high-yield savings account with an online bank can offer greater convenience and accessibility.

Where can I get 5% interest on my savings?

You may find 5% interest on your savings account through an online bank. Consider opening a money market account, which provides better rates than regular savings accounts. Additionally, you could invest in Treasury direct bonds or certificates of deposit (CDs), which offer a fixed return rate and guaranteed returns, respectively.

Where can I get 10% interest on my money?

You may not find 10% interest on your money through traditional banks or savings accounts. However, you can explore alternative investment vehicles like peer-to-peer lending opportunities and exchange-traded funds (ETFs) for higher investment returns. Researching and understanding the risks associated with these options before investing is important.

Conclusion

In conclusion, investing in CDs can be an excellent way to save money. While the initial investment amount may be large, their returns are guaranteed. Additionally, you should consider money market accounts as they offer higher yields than regular savings accounts. Investing in index funds or ETFs is also a good way to diversify your portfolio.

Furthermore, you can open a high-yield savings account with an online bank for easier accessibility and convenience. Finally, you can use peer-to-peer lending opportunities to better use your money. To maximize your savings rate and ensure secure returns on your hard-earned funds without taking unnecessary risks, look into these low-rate savings account alternatives today.

-

Investment Dec 21, 2023

Investment Dec 21, 2023What Is The Nasdaq 100 Index?

Learn the Nasdaq 100 Index and how to invest in it. In this guide, we explain the index's components, its differences from the S and P 500, and frequently asked questions about investing in it.

-

Know-how Sep 07, 2024

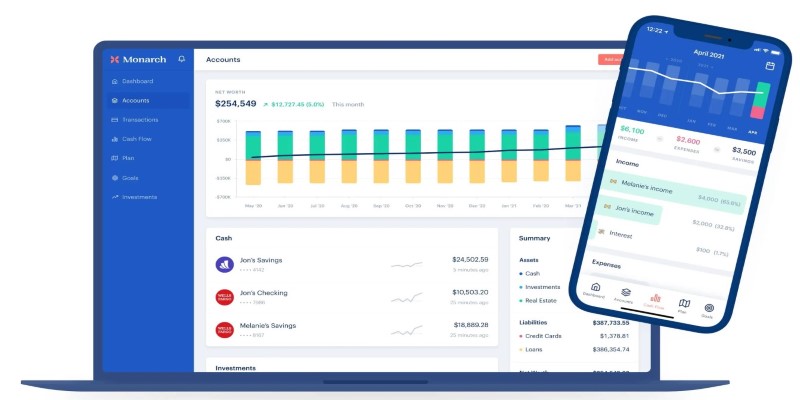

Know-how Sep 07, 2024Finding the Right Net Worth Tracker: A Guide for 2024

How to choose the best net worth tracker in 2024 with our detailed guide. Learn what features to look for and how to find a tracker that fits your financial goals

-

Know-how Nov 06, 2023

Know-how Nov 06, 2023Unlocking More Credit: Citizens Bank Credit Limit Increase Explained

Discover how to increase your Citizens Bank credit limit and unlock more financial flexibility with our step-by-step guide

-

Know-how Nov 07, 2023

Know-how Nov 07, 2023Boost Your Spending Power: Requesting a Chase Credit Limit Increase

Want to boost your spending power? Learn how to request a Chase credit limit increase and manage your finances more effectively.